As you approach your retirement years, it’s easy to wonder whether buying a new home is a smart move or not. You’re probably close to paying off your current mortgage – if you haven’t already done so – and you may not want to take on a new mortgage knowing may be living on a more limited budget.

Despite your reservations, there are plenty of good reasons to downsize to a new home before you retire rather than staying where you are or moving into an apartment. Once you think carefully about your options, you may see this is the right move for you.

1. Less Maintenance

Older homes need more repairs. You either need to have the know-how and physical strength to do these repairs yourself or the money to pay someone to do them for you. This is a struggle for many retirees, especially when things break down one after the other. Some people may buy an older home or stay in an older home and have no issues. Others may move into one but problems can arise when you don’t know truly what’s behind the walls and end up with renovation after renovation needed. In a brand new home, though, you’re not going to have these same worries. New things are significantly less likely to break down, and when they do, they’re often covered by new home warranty.

2. More Upgrades

In your retirement years, it’s easy to just want things that are a bit… nicer. This might be ceramic tile flooring in the entryway, beautiful quartz countertops, or the luxury of a five-piece ensuite in the master bedroom. You may not have these types of things in your current home or may want to upgrade/modernize them.

One of the best things about building a brand new home is you can selectively choose the upgrades you want – and avoid paying for the ones you don’t. For example, if you’ve been looking forward to a tall glass shower and quartz countertops in your new ensuite, but don’t want a massive bathroom to clean – you can have those features without having to pay for the additional unwanted space. You can also look for upgraded features in select new move-in ready homes that are exactly what you’re looking for.

3. Downsizing with Space for Entertaining

Whether your kids have already moved out or you know it’s coming up in a few years, you’re starting to see how the large family home that’s served you so well can start to feel a bit well, large. A smaller home means lower utility costs and less space to clean.

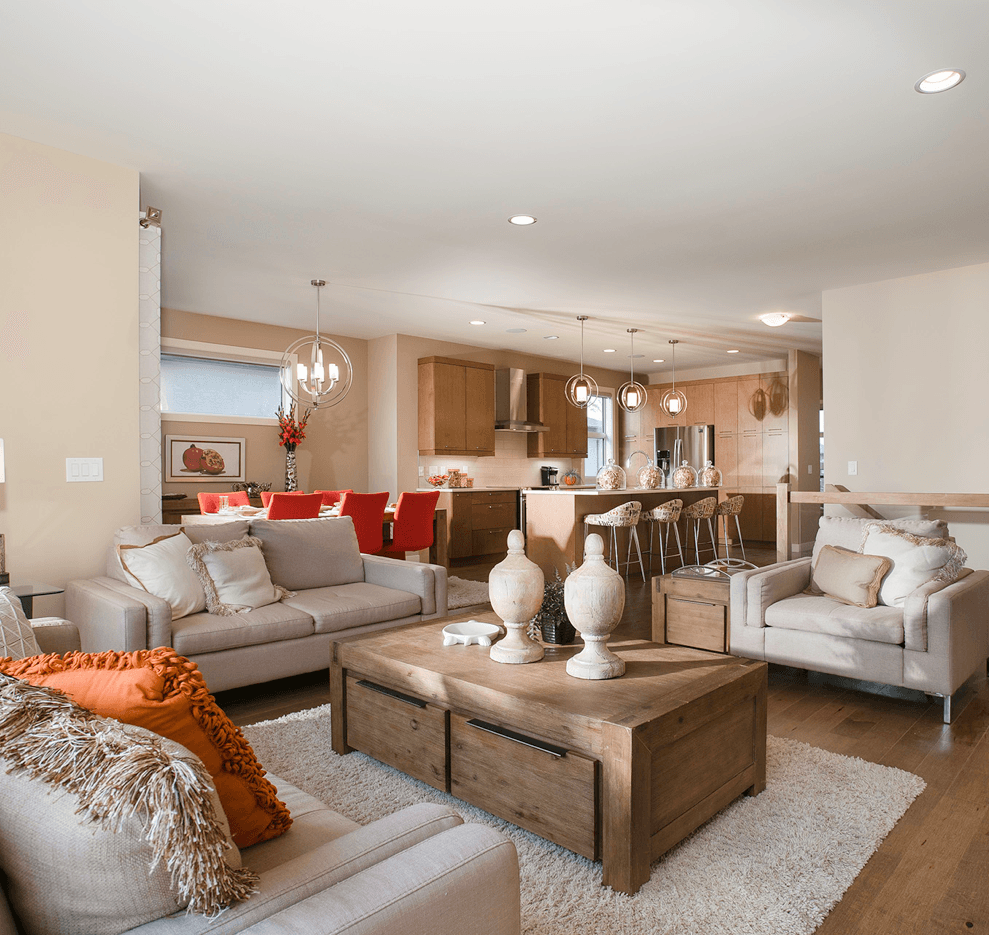

At the same time, you can choose a new home that has plenty of space and features for entertaining. Today’s open-concept plans help you feel connected and sociable in a smaller home.

4. Better Layouts

When you buy a new home, you have some control over the layout and you can select a floor plan that’s going to better meet your changing needs. For instance, you might choose a home that has a laundry on the second floor or the main floor so you won’t have to carry laundry baskets up and down stairs. Choosing a new bungalow or one that has bedrooms on the main floor might be a good choice.

As a seasoned homeowner, you also probably have a better sense of what works for your lifestyle. You might want to be able to escape to a den at the front of the home for some quiet as you read your book, or you might love sliding doors to a deck in the back for your weekend backyard barbeques. You can get just what you need in a new home.

5. Premium Locations

Most of the time, new homes are built in new Winnipeg neighbourhoods. These neighbourhoods are carefully planned to meet your every need. You won’t need to travel far to reach a grocery store or a bank. You can exercise your mind and body by taking walks along the walking trails. These features aren’t always available in the neighbourhood where you currently live.

6. Affordability

You might be surprised to learn a new home is more affordable than you think. With the equity in your current home, your monthly mortgage payment could be far less than the amount you’d pay for rent in a senior living complex or apartment building. You may even be able to purchase your new home without taking out a mortgage depending on your situation.

You’ll also be able to control the costs in your new home. You pay for the upgrades you really want while choosing the standard materials for things that aren’t important to you. Best of all, new homes are incredibly energy-efficient, so you’ll probably spend far less on your utilities than you would in an older home.

Buying a new home for the retirement years makes sense in a lot of ways. Why don’t you come take a look at the types of homes Sterling has to offer? Our Sales Agents can answer any questions you might have about whether or not this choice makes sense for you.